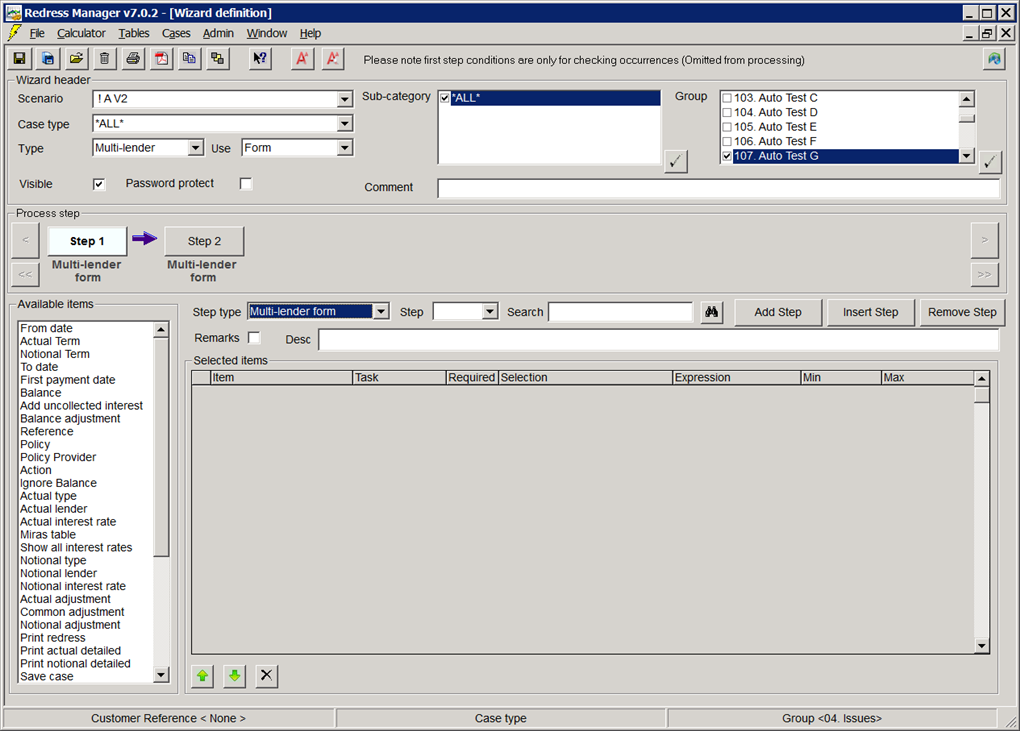

Below are options relating to the various items on the multi-lender step type screen:

|

From date |

Option to use previous period or calculation from / to dates. Please note to use these options, there must already be existing periods or calcs present. There is an option to use 1st adjustment date. To ensure this works correctly the adjustment set has to be open. (Note if ‘From date’ is entered into the wizard via a user form with a wizard containing minimum default values for ‘ To date’ and ‘First payment date’ , these defaults are ignored. )

|

|

To date |

Option to use previous period or calculation from / to dates and current from date + term,’ Today’, Last Adjustment to date and Last Adjustment to date + 1 day. For the last two options to work correctly, the adjustment set has to be open. If the “To date” is set to “From date + term”, the “Actual term” must be specified in the wizard and it must be before the “To date”. This option can be added multiple times to each Multi-lender wizard step.

|

|

First payment |

Options are ‘From date’ or ‘From date + 1 month’ |

|

Actual Term |

Options are Years & Months or just Months. Please note with selection set to “Years and months”, the Min and Max values will apply only to the Years field.

|

|

Notional term |

Option available to set the term to be the same as the actual term or alternatively a term can be specified using the value column. |

|

Balance |

Specify the balance to be used in the calculation |

|

Balance adjustment |

Select the balance adjustment required from the dropdown list |

|

Ignore Balance |

Select the option required from the dropdown list |

|

Add uncollected interest |

Specify whether to add the uncollected interest or not by selecting Yes or No |

|

Reference |

Specify the reference number for the case |

|

Policy |

Specify the reference number for the policy |

|

|

■ No check – does not check if the policy number entered has been used in any case already created |

|

|

■ Check existing – checks if the policy number entered has been used in any case already created |

|

Policy provider |

Select the policy provider from the dropdown list |

|

Action |

Specify what type of calculation you wish to do e.g. Loan related. This must be set before selecting the lender and interest rates otherwise the lender and interest rates lists will be empty

|

|

Show all interest rates |

Specify whether to show all the interest rate tables available or not by selecting Yes or No |

|

Actual type |

Select the actual mortgage / loan type: Repayment or Interest only |

|

Actual lender |

Select the actual mortgage / loan lender required. This is based on Action. For example, if the action is mortgage related, the lender list will be updated with a list of mortgage lenders. If the action is loan related, the lender list will be updated with a list of loan lenders.

|

|

Actual interest rate |

Select the actual mortgage / loan interest rate required. This is based on Actual Lender and Show all interest rates. For example, if the Actual Lender is Halifax, then the interest rates available will be those that are provided by Halifax. If the Show all interest rates is set to Yes, then all the interest rate tables will become available not just the ones specific to the lender

|

|

Notional type |

Select the notional mortgage / loan type: Repayment or Interest only |

|

Notional lender |

Select the notional mortgage / loan lender required. This is based on Action |

|

Notional interest rate |

Select the notional mortgage / loan interest rate required. This is based on Notional Lender and Show all interest rates |

|

Actual adjustment |

Specify whether to clear the actual adjustment selection on the multilender screen or to select a new adjustment set. For the latter, make sure the name of the adjustment set is entered in the value column.

|

|

Common adjustment |

Performs a similar action to Actual adjustment but for the common adjustment selection on the multilender screen |

|

Notional adjustment |

Performs a similar action to Actual adjustment but for the notional adjustment selection on the multilender screen |

|

Save case |

Specify whether to Save the case or to Save and Exit |

You also have the option to create and print a PDF for the following (based on the user’s directory settings).:

■ Redress

■ Actual detailed output (This option can be added in multiple times within each step)

■ Notional detailed output ((This option can be added in multiple times within each step)

By default, the minimum values for "To date" & "First payment date" are calculated from the "From date". These values are only calculated if the "From date", “To date” and “First payment date” have been entered in the course of running the Wizard.

The ‘Ignore balance’ item will only work if it is set after the ‘Action’ item. The ‘Ignore balance’ can only be set if ‘Action’ is set to mortgage or loan related.

For Actual and Notional terms, the value field can only be entered in years and not in years and months.

If a term is in years and months, the value field will be in years. However if you allow the user to enter the term via the user form, they can define the term in years and months. Please note the default minimum term is set to 12. The interpretation of this value is based on the format of the term. If the term is in years and months then this is interpreted as 12 years and if the term is in months then this is interpreted as 12 months. The default minimum term can be modified to suit your cases.

If the From Date is “Set” in the wizard, the “Min/Max” values for the “First Payment” and “To Date” are ignored.

If the Multi-Lender case has one tab and ’From date’ is to “Set and Enter” and ‘Previous To Date’ is a preset value, the ‘from date’ will not be set as there are no previous calculation dates to select from.

Related Topics