Multi-part Consolidation Calculator

The consolidation calculator allows for more complex debt and investment / pension scenario’s where the periods and/or calculations of the actual and notional parts don’t line up on a one to one basis. Examples of this include;

- An investment where the actual side is multiple investments

- An investment where the notional side is split based on risk (e.g. Index & interest rate)

- A debt where the customer has consolidated multiple items (e.g. credit card, loans, mortgage) into one or two alternatives (e.g. large mortgage)

The options for consolidation are as follows;

|

Debt |

{ |

Loan |

} |

|

{ |

|

} |

|

|

|

Mortgage |

or |

Premiums + Interest |

|

||||

|

|

Credit |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Followed by Redress + Interest or Redress

with No Interest |

||||

|

Investment or Pension |

{ |

Fund |

} |

|

{ |

|

} |

|

|

Interest rollup |

or |

Premiums + Interest |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Followed by Redress + Interest or Redress

with No Interest |

||||

Based on the case type selected (Debt or Investment/Pension), different options will be made available.

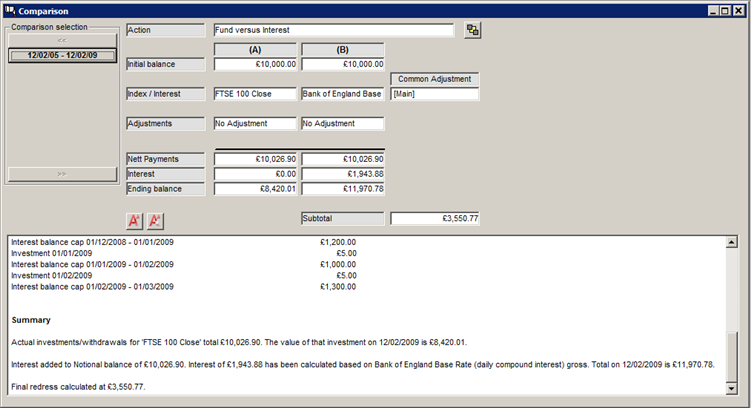

The consolidation screens work by comparing the final position of the actual and notional entries to calculate redress. This includes any surrender values for debts.

In addition to the split items, adjustments and calculations are assigned a Part, rather than a Loan. This is how Redress Manager joins calculations together and compares the final results.

There is a new adjustment ‘Set adj portion %’ which is only available to the consolidation screens. This adjustment allows a portion of other adjustments to be applied to different Parts of the calculation. Any adjustment (other than rate specific items and/or minimum payments) starting within the portion period will be split according to the percentage. You need to specify the portion for each part as within some calculations you may only wish to use part of the value.

Examples of where ‘Set adj portion %’ will be useful include where you wish to compare an investment to a split between another indices (e.g. WMA or other) and an interest rate (e.g. BOE fixed rate or other).

Related Topics