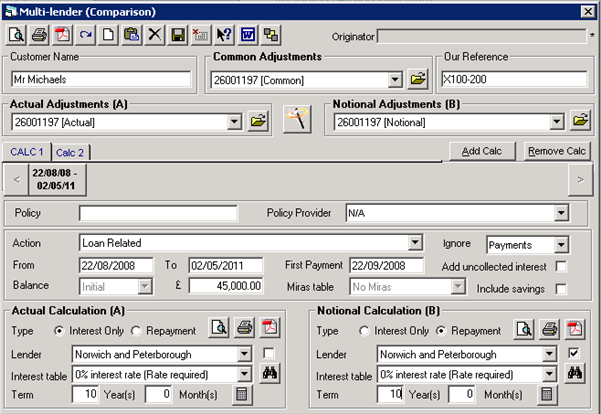

This screen is completed as follows (either TAB or clicking using the mouse may be used to move between entry fields):

|

a) |

Clients

name as you wish to see on printouts |

|

|

b) |

Common

adjustment set to be used in calculations (Added to other selected adjustments) |

|

|

c) |

Clients

Mortgage/Loan Reference as you wish to see on printouts |

|

|

d) |

Actual

adjustments, includes all adjustments for actual calculations (over one or

more lenders) |

|

|

e) |

Notional

adjustments, includes all adjustments for notional calculations (over one or

more lenders) |

|

|

f) |

Policy

Ref for current calculation |

|

|

g) |

Policy

provider for current calculation |

|

|

h) |

Action

of this tab |

|

|

|

■ Mortgage Related |

|

|

|

■ Premiums + Interest |

|

|

|

■ Redress + Interest |

|

|

|

■ Redress + Premiums + Interest |

|

|

|

■ Redress + Mortgage Payments + Interest |

|

|

|

■ Redress + Premiums + Mortgage Payments +

Interest |

|

|

|

■ Interest Only |

|

|

|

■ Redress - No Interest |

|

|

|

■ Loan Related |

|

|

|

■ Redress + Loan Payments + Interest |

|

|

|

■ Redress + Premiums + Loan Payments +

Interest |

|

|

i) |

Ignore

balance/Ignore payments. If selected from the dropdown these will exclude the

balance/payment difference from the mortgage/loan related redress. |

|

|

j) |

From

date for this lender (the first day of recalculation / comparison) |

|

|

k) |

To

date for this lender (the date the recalculation / comparison should work to

e.g. today or end of mortgage/loan term. If this is not entered then the

system will add the term onto the start date) |

|

|

l) |

First

payment for this lender (date the first payment was made) |

|

|

m) |

Add

uncollected interest. If selected (tick in box) this will add in any

uncollected interest to the first payment made. |

|

|

n) |

Balance type -

initial for first mortgage/loan or CFWD (Carry forward), Increase (Carry

forward and increase), Decrease (carry forward and decrease), Set Amount

(Actual start balance) for second lender. |

|

|

o) |

Balance

£, is the amount for original mortgage/loan or increase / decrease amount |

|

|

p) |

MIRAS

table to be used for calculation |

|

|

q) |

Include

savings option for comparison calculation |

|

|

|

|

|

Actual & Notional calculation

|

a) |

Mortgage/loan type (Interest only or Repayment) |

|

b) |

Lender table - financial institution funds borrowed from (e.g. Bank, Building Society…). When selecting the lender a number of them have multiple options, depending on the lender (i.e. Annual, Daily). Care is needed when selecting the correct lender. |

|

c) |

Interest rate table (place highlighted bar on relevant entry for this particular recalculation (see Interest Rate Setup)). You

can use the match icon |

|

d) |

Mortgage/loan term (period, years and months) |

|

e) |

Reduced interest rate lists option to filter interest rates applicable only to the selected lender |

|

|

Run wizard |

|

|

Add calculation (policy) to case (Can have 10 calculations per case). Option to copy lenders from previous policy. |

|

|

Remove calculation from case |

|

|

|

|

|

Calculate and display comparison or detailed analysis (top row - comparison) |

|

|

|

|

|

Calculate and print comparison or detailed analysis (top row - comparison). Note printed comparisons will include a new summary page when multiple calculations are included. |

|

|

|

|

|

Create PDF file. When selecting this option you will be requested to enter a file name for the file. PDF files replicate printed output and FREE readers are available. |

|

|

|

|

|

Refresh interest and lender lists |

|

|

|

|

|

Add new lender (up to 25 per policy), option to calculate term based on previous lender. The previous lender and interest table will be carried forward. |

|

|

|

|

|

Insert new lender prior to selected entry |

|

|

|

|

|

Delete selected item |

|

|

|

|

|

Save current comparison data for client |

|

|

|

|

|

Add redress information |

|

|

|

|

|

Validate information entered (Checks various items to ensure data is correct - this feature is highly recommended) |

|

|

|

|

|

Mail Merge (Optional extra, considerable time saving when producing letters) |

|

|

|

|

|

Exit current screen |

|

|

|

|

|

Open/Edit the corresponding adjustment set |

|

|

|

|

|

Recalculate term (very useful when gap between mortgages) |

Related Topics

Calculators

Verify Screen

Comparison Screen Display

Redress Information