The System Adjustment Generator has different calculation type options depending on the type of case you are currently working on.

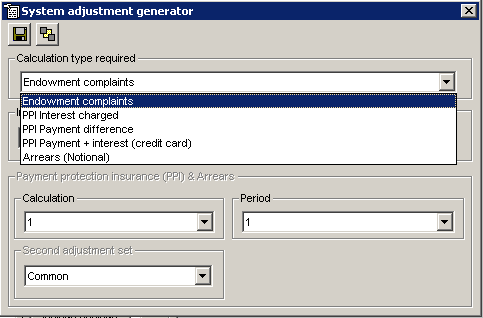

From an Endowment Mortgage case type, the options available are as shown in the screen below:

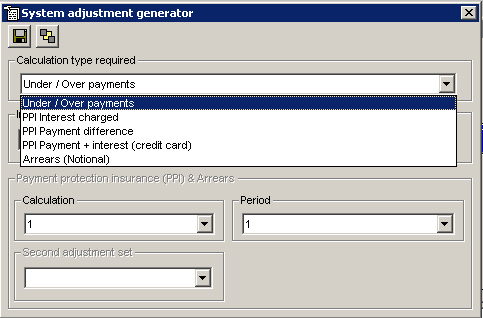

If you are working on a Single Premium Payment Protection case type, the options available are as shown in the screen below:

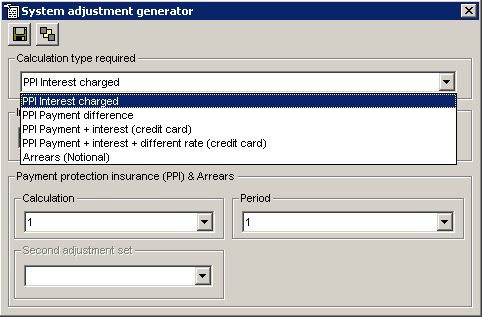

However, for a credit card case calculation for instance, using a Monthly Premium Payment Protection case type, the available options are as shown below:

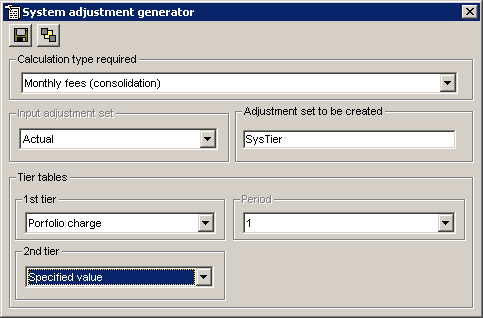

For investments there is the option to generate monthly fees using tiered tables

The ‘Calculation type required’ options are:

Endowment complaints - used within Endowment Complaint cases where the customer has made a set payment for a period of time, therefore resulting in under or over payments.

PPI Interest charged - The PPI Interest charged used within cases that require a refund of unfair interest charges, by calculating the differences.

PPI Payment difference - This option is typically used in PPI cases to refund unfair payments by calculating the difference between the Actual and the Notional payments.

PPI Payment + interest (credit card) - this option is generally used for Credit Card complaint cases where both the difference in payments and interest is to be refunded, a combination of options PPI Interest charged and PPI Payment difference.

Under / Over payments - This option is similar to Endowment complaints option but only available for loan PPI cases and Debt consolidation.

PPI Payment + interest + different rate (credit card) - This option is only available when dealing with Credit Card complaints where a charge of a different rate was made on the card because of the PPI. It allows for the refund of the difference in payments, interests and the rates. A second adjustment set must be available in order to use this option.

Excess payments (consolidation) – this option is only available when dealing with debt consolidation cases. The system using the selected adjustment sets and creates a new adjustment including the additional payments made on the actual side of the calculation starts in the first month (need to ignore start of credit issues). This is useful when comparing debt on products that would have naturally ended on the notional side of the calculation (e.g. loans).

Monthly fees (consolidation) – this option is only available when dealing with investment consolidation cases. The system uses the ‘Monthly accrued fees %’ adjustment and creates adjustments for calc 2 using either tiered rates and/or the rates specified by the adjustment. This can be used when evaluating charges on investment cases.

Arrears (Notional) – this option works using the ‘Set arrears balance’ adjustment and will adjust the balance based on whether under or over payments are made. This is useful when looking at an account which has gone into arrears.

Note: When running the system generator on multiple tab cases, it will need to run on initial tabs first to get the current position for the tab you wish to run it against. This can cause unexpected values.

Related Topics