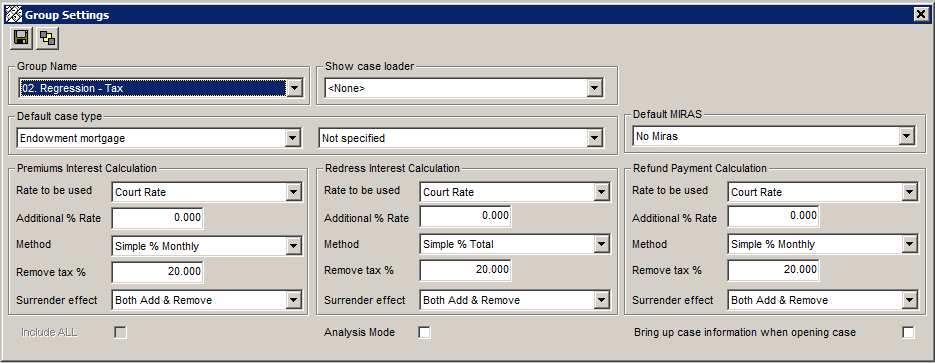

The ‘Show case loader’ dropdown determines whether the group will be able to access the ‘Load new case’ option and which template it will use.

The Default MIRAS option sets the default when creating a new Multi Lender screen related case.

For each group you can define the appropriate interest rate table to be used along with any additional rate to be added to that. The method selected can be compound or simple.

The default case type when set selects the case type and subcategory that will be selected by default when creating a new case using this group.

The three sections for interest calculations are based on selections within the Multi-lender screen;

|

a) |

Premiums Interest Calculation parameters - Premiums + Interest selection (note this includes subsequent premiums paid after the interest is added at the Redress + Premiums + Interest stage) |

|

|

|

|

b) |

Redress Interest Calculation parameters - Redress + Interest and Interest Only |

|

|

|

|

c) |

Refund Payment Calculation parameters - Mortgage Payments + Interest |

In terms of the Consolidation screen;

|

a) |

Redress + Interest and Dividends use the Redress + Interest settings as defaults |

|

b) |

Premiums + Interest and Interest rollup use Premiums + Interest |

In terms of the Investment screen;

|

a) |

Dividends use the Redress + Interest settings as defaults |

The sub items are based on the following;

|

1. |

Rate to be used |

BOE Base Rate (Base rate table), Court Rate (Court rate table 8/15%), <No Interest> (0% Interest), FSCS Fair rate (to be used by FSCS only where applicable), BOE Fixed rate |

|

|

|

|

||

|

|

|

|

|

|

2. |

Additional % Rate |

Rate to be added to above table (e.g. BOE Base Rate + 1%) |

|

|

|

|

|

|

|

3. |

Method |

Simple Total % (Sum up all items and adding simple interest from day one) |

|

|

|

|

Compound Monthly % (Apply interest, compounding interest at the end of each month) |

|

|

|

|

Compound Annual % (Apply interest, compounding interest at the end of the year i.e. 31/12) |

|

|

|

|

Simple Monthly % (Apply simple interest to amounts as and when they occur) |

|

|

|

|

Compound % Daily (Apply interest, compounding interest at the end of each day) |

|

|

|

|

Compound % AER (A special method of compounding interest) |

|

|

|

|

Compound % monthly APR (A special method of compounding interest using APR) |

|

|

|

|

Compound % annual Fixed (A special method of compounding interest using the effective rate) Compound % month end (A new method to compound interest at the end of every month) Compound % Anniversary (A new method to add interest on the anniversary of the account based on the start date) |

|

|

|

|

|

|

|

4. |

Remove tax % |

% to be removed for tax purposes |

|

|

|

|

|

|

|

5. |

Surrender effect |

None |

- any increase or decrease in surrender value won’t affect this item |

|

|

|

Remove increase |

- remove any increase in surrender value from this item |

|

|

|

Add decrease |

- add any decrease in surrender value to this item |

|

|

|

Both Add & Remove |

- apply any increase or decrease in surrender value to this item |

Note: Increases or decreases will only be added / removed once; this merely tells the system which items can be affected by changes in surrender value.

Analysis Mode - Set by default to ON, uncheck the checkbox to set the analysis mode OFF

Bring up case information when opening case – Check to set the Case Information screen to appear each time you open up an existing case

Note: We STRONGLY advise all companies to ensure they agree with the results produced by Redress Manager in terms of compounding interest.

Related Topics